Bitcoin is centralized, but not in the way you think it is.

As our society becomes increasingly dependent on digital spaces, it is vital that the ecosystems we build reflect our shared values and represent the common interest. Despite differences of opinion, history, and circumstance, most people value fairness and freedom. Our interpretation of these values can conflict, but it finds common purchase in democratic thought. The institutions we raise may fall short of our ideals, as they are susceptible to private interest and corruption, but we persist in their construction as we hold a truth to be self-evident. We understand that it is from the consent of the governed that those in control obtain their legitimacy and authority, and not from the divine right of kings to rule.

The democratic processes and mechanisms we create establish a common interest and afford us choice, however limited. These structures represent an attempt to decentralize the control of our societies. Serious issues exist in our systems of democratic governance, but many of the flaws we see are a result of inadequate decentralized, or democratized, control.

Democracy decentralizes, and a tyranny, real or digital, thrives in an environment where control is centralized. What then of Bitcoin?

Bitcoin Orthodoxy

The Problem is trust

On October 31, 2008, as the world reeled from a global financial credit crisis, Satoshi Nakamoto published their whitepaper on Bitcoin. Despite a skeptical reception on the Metzdowd cryptography mailing list, the project’s decentralized nature helped to attract the technically minded and those critical of the financial system. The pseudonymous author(s) positioned the technology as an electronic form of cash free from the control of central banks as per the Bitcoin release announcement published to the P2P Foundation website on February 11, 2009.

“…The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts. Their massive overhead costs make micropayments impossible… …With e-currency based on cryptographic proof, without the need to trust a third party middleman, money can be secure and transactions effortless.

…”

Nakamoto was not only attempting to create a peer-to-peer form of electronic cash that solved the double spend problem, but was attempting to address the issue of corruption in centralized banking by eliminating them as a dependency for payment interactions. This view is supported by Nakamoto’s own writings as well as by the contents written to the Genesis Block, the first transaction ever recorded to the Bitcoin blockchain. The input of the transaction for the Genesis Block contains a hexadecimal sigscript which, when translated to human readable ASCII, reads as follows:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”

This is a clear reference to Nakamoto’s dim view of the concentrated power of central banks. Bitcoin appeared to be an attempt to bound self-interest in the financial system. It was hoped that this could be achieved by eliminating intermediaries from payment interactions through technological means. The Bitcoin protocol was envisioned as a structure that did not consider its own self-interest in decision making, it was neutral, its sole interest was in the correct functioning of the system. Bitcoin didn’t make decisions as we typically think of them when discussing application logic in centralized digital systems as, it was claimed, there was no central point where the system could be controlled or data manipulated. Bitcoin was decentralized.

The Bitcoin protocol defined a set of behaviors that participants would adhere to when participating in the network, failure to conform to the expected behaviors as defined in the specification would result in non-participation. The consensus mechanism, known as Proof-of-Work, incentivized participants, protected the network, and coordinated the transactions needed to operate it. Central decision making was replaced with decentralized functionality.

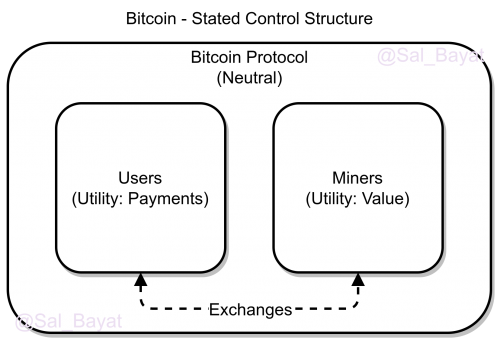

As Bitcoin was a protocol implemented in code and not a person, it would have no interest of its own, however it would be responsible for controlling self-interest in the network by regulating exchanges between participants. The interests of the Users concerned with the utility of payments, and the Miners concerned with the value of the bitcoins they mine, are balanced by the neutral Bitcoin Protocol. The balancing of interests between the Users and Miners would be a challenge however, as users seek to maximize utility for as little cost as possible, and those interested in turning a profit wish to maximize the value exchanged for the services they provide, their interests at odds with each other.

If this financial high wire act succeeded, then Nakamoto would accomplish something that had never been done before, and the benefits would be revolutionary. With no central party the potential for uncontrolled self-interest, also known as corruption, is eliminated. Meanwhile, the self-interest of Users and Miners would be bounded by the neutral Bitcoin Protocol, which defines the types and range of interactions which can take place between participants on the network.

There could finally be a financial system where utility reigned supreme over the corrupting influence of middlemen. Payments would flow with pleasurable ease, efficiencies would emerge that put the incumbent financial system to shame. Transaction cost driven to such lows that the corrupt central bankers of the world would weep as they watched their wealth and power evaporate. A financial Utopia would emerge where everyone would be better off. After all, the problem lies in trusting the centralized financial system. Those greedy central bankers who make our money worthless through quantitative easing, make micropayments impossible with high transaction fees, and create systemic risk through financial institutions that lend our money out in waves of credit, leaving barely a fraction in reserve. The problem is trust.

From a technical perspective, Nakamoto’s proposal was brilliant. Bitcoin’s Proof-of-Work would simultaneously provide a mechanism to ensure accountability and verification of transactions to solve the double spend problem, incentivize the Miners (payment processors) through mining rewards to provide utility to end users, enable the system to be decentralized with no central point of failure, all the while mitigating bad actors attempting to attack the network. The Proof-of-Work consensus mechanism replaced the systems and functions that are controlled and managed by a human intelligence in centralized banking. The future of finance had arrived.

The alleged decentralized nature of Bitcoin was, and still is, one of the main talking points used to promote and popularize Bitcoin by its Creator(s) and others.

Why then, after more than a decade, have we not reached the financial promised land? And why aren’t we overwhelmingly using Bitcoin for payment interactions? For answers to these questions and others, we must examine Bitcoin’s underlying structure, and view the functionality and control of a system as separate properties. By doing so, we can see that Bitcoin was designed to fail, as it is prevented from being used as an effective payment system.

Corruption is advanced by control, and Bitcoin is entirely centralized where it matters most.

Functionality vs. Control

Cryptocurrencies exist in a cognitive blind spot

Systems may be distributed, decentralized, or centralized, but they all share the same two fundamental and interrelated, but separate properties: Functionality and Control. For example, my work in a factory may be decentralized to my team, or distributed to each individual team member, but control of the work is orchestrated by our manager, who in turn takes their direction from the owner. Functionality is distributed and decentralized, but control is centralized in a single person.

To better illustrate this distinction, let us consider the control of Bitcoin when compared to a corporate special interest. The McDonald’s system has separate franchises, the operation of each being independent but governed by a common set of rules. Within each restaurant the operation of processes is distributed to a team of individuals. Different employees take orders, cook the burgers, and package them for customers. The functionality that drives the operation of McDonald’s is distributed and decentralized. We might say that the behavior and actions of the system’s participants are governed by a McProtocol.

Do we refer to McDonald’s as a decentralized hamburger delivery system? Certainly not, as it is understood that the actions of all participants in this system are orchestrated by, and represent the interests of, those in control of McDonald’s. Although there are many different owners and employees, the self-interest of participants is aligned towards the goal of acquiring as much profit as possible for McDonald’s.

Is Bitcoin meaningfully different to the example above? If everything is controlled by a special interest whose only goal is financial gain, what is the purpose of decentralized functionality? The difference between function and control is obvious to almost everyone, yet in discussions about decentralized digital systems this distinction is almost never addressed. Despite our bias towards, and familiarity with, centralized organizational systems, it would appear that cryptocurrencies exist in a cognitive blind spot.

Criticism of Bitcoin’s decentralization tends to focus on Mining functionality. If this issue seriously wounds the claims of decentralization, then the nature of Bitcoin’s centralized control structure is fatal and far more damning. This centralization has existed since the creation of Bitcoin and is fundamental to its design. For someone who railed against the corruption of central banking, it is curious that Nakamoto would design Bitcoin to be controlled by a single special interest group who share identical goals, interests, and intentions.

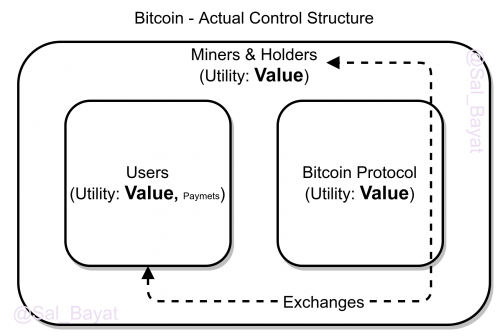

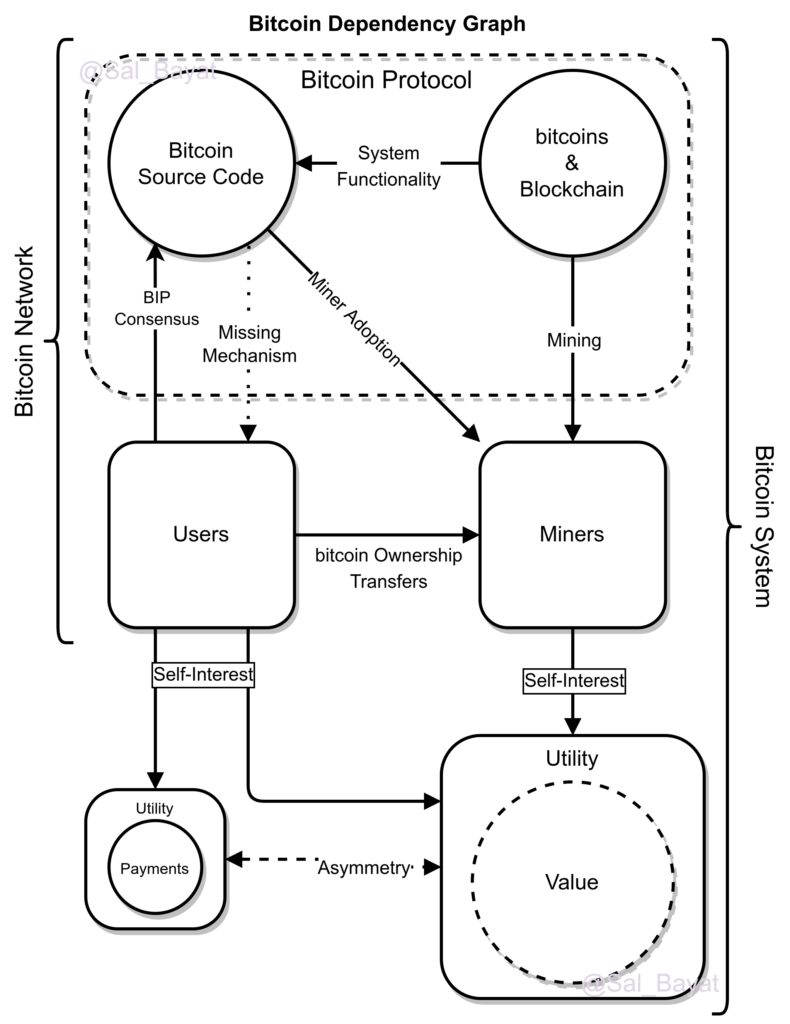

“Who controls Bitcoin?”, asks the clueless reporter. “No one. It’s… decentralized.” replies the social media billionaire as he adjusts his sunglasses and talks euphemistically of tax evasion. But this answer is misleading, if not an outright lie, as evidenced by our Bitcoin dependency graph. Bitcoin is controlled by the Miners and majority coin holders whose only concern is increasing the value of bitcoin. This is the goal that must be pursued at any cost, and why Bitcoin uses decentralized functionality as a smokescreen to obscure centralized control.

I Drink Your Milkshake

Miners are the ultimate authority in Bitcoin

The Bitcoin Protocol is governed by its source code, it determines the decentralized functionality of the network. The source code was originally written by Satoshi Nakamoto and is now maintained by a group of independent third parties who have no financial interest in an ever increasing price for bitcoin… just kidding. In reality, the source maintainers are associated with organizations like Chaincode Labs, OkCoin, BitMEX, Blockstream, MIT DCI, etc. The MIT Digital Currency Initiative lends an air of legitimacy to the guardians of the source, until further investigation reveals that it is an organization funded by Chaincode, BitMEX, Jack Dorsey, Coinshares (Europe’s largest digital asset management company), and others. The interests of these organizations and their owners are aligned in that they seek to drive the price of Bitcoin to new all-time highs.

“So what? They aren’t in control of the ecosystem! Anyone can make a change to Bitcoin! It’s Open Source!” As the blocksize debate demonstrated, the only changes Bitcoin adopts are ones which can result in an increase to the value of bitcoin. Changes that represent the interests of Users who wish to use Bitcoin as a payment system are irrelevant and have been since the protocol was designed. Moreover, there is a powerful group which can exercise veto power over any proposed change to the protocol.

You might have noticed where the majority of the arrows point to on our dependency graph. Bitcoin’s Miners are the ultimate gatekeepers for the system. They control the network, both in terms of functionality and in terms of governance (control). Only changes that are voluntarily accepted by the Miners can “achieve consensus”, and as humans are self-interested and Miners do not operate nodes out of the kindness of their hearts, the only changes that are acceptable are ones that either maintain or potentially increase the value of the bitcoins they mine.

Miners are the ultimate authority in Bitcoin and, regardless of how decentralized mining is in terms of functionality, Miners will always act as a cohesive group as their self-interest is aligned towards the pursuit of value. This dominant interest in the system produces an asymmetry of utility between those who seek to increase the value of bitcoin and Users who wish to use the network for payments. This asymmetry of utility makes it almost impossible for other interests to be represented in the network. In the case of Bitcoin, it cannot be used as an effective payment system as the interests of those seeking to derive other utility from the network are not a consideration.

If a person created a game, dictated the rules, acted as referee, and then competed with other participants, would we call this fair? Those who pursue value in a system should not govern it, and set the rules for all participants, as this leads to abuses of power.

Dear Leader

The Satoshi Sidestep

Just as it is in politics, if you want to understand someone’s motivations and the interests they represent, it’s best to ask who’s paying them. Nakamoto, who created the block reward mechanism that incentivizes Miners, serves as Bitcoin’s financier. The system is designed to put complete control of the network into the hands of the Miners. Nakamoto then ensured their loyalty by paying them an asset that is guaranteed to double in value every four years by way of the halving schedule. Moreover, Nakamoto distributed rewards asymmetrically to the early Miners, 50% of the coin supply was distributed in the first four years. It is in this way that a system which always represents Nakamoto’s own interests was created. All good things flow from the beneficence of the Creator(s).

Nakamoto even used an undisclosed multi-threaded mining algorithm that ensured control of Bitcoin’s network in the early days. This is typically portrayed as a heroic attempt by a single person to stabilize a nascent network. Ignoring completely that stability of the network leading to increased adoption, token value, and mining rewards coincides nicely with Nakamoto’s own self-interest. Nakamoto would also frequently ignore and sidestep direct questions about the viability of a system that looked more like a speculative asset than a currency. When asked directly about transactional performance, Nakamoto would redirect and from the beginning chose to focus on bandwidth when discussing performance concerns.

We are asked to believe that a skilled and technically brilliant computer scientist, who was familiar with the transactional requirements of payment networks, and intended to design Bitcoin as a payment system, failed to remember the most fundamental metric used to measure the performance of online transaction processing (OLTP) systems? Nakamoto was surely aware of the importance of transactional throughput, measured by transactions per second (TPS). Bitcoin is capable of around 10 TPS, and in 2008, VISA alone was capable of 10,000 transactions per second. Bitcoin, in 2022, is off by three orders of magnitude when compared to a single 14-year-old payment network. I would ask the reader what their first consideration would be if they intended to create a global payment system. Would it be transactional performance or an ironclad system of asset ownership?

Even if we take the double spend problem into account, you cannot have a functional payment network without sane transactional throughput. Of course, when it comes to hard questions Nakamoto is famous for the Satoshi Sidestep. Anyone who has extensively read Nakamoto’s writing and correspondence gets a sense the author’s intelligence and thoughtfulness. But after stumbling across their claim that “I’m better with code than with words though.”, we are left to wonder if this is an example of humble self-depreciation or calculated misdirection.

Intention is hard to prove, more so when the subject we are examining took extraordinary measures to remain anonymous and carefully controlled their online persona. The fact that they paid cash for a domain registration would seem to indicate they may have understood the implications of what they were doing. Perhaps their identity would have had us question their intentions too closely. Nevertheless, let us assume the best of Nakamoto and constrain our inquiry to their actions.

Words Are Wind

Bitcoin itself is a form of fiat

When we consider Nakamoto’s actions by examining Bitcoin’s design, what we observe is a system predicated on ownership of an artificially scarce resource, known as bitcoin, of which the Creator(s) controls a non-trivial percentage. The system has its own monetary policy and deflationary money supply, with around 90% of the planned 21,000,000 tokens currently in circulation. The asymmetrical distribution of this artificially scarce resource creates a feudal structure more reminiscent of medieval England than modern networks. It is a structure that guarantees a vast disparity of wealth within its own network and any other system that is linked to it. Since its inception, the performance profile of the network itself seems to be tailored more towards transfers of real-estate than to micro-payments. Control of the network and protocol is entirely in the hands of the Miners, individuals who are being paid by Bitcoin’s Creator(s).

The self-interest of the Creator(s), Miners, and early adopters is aligned towards the pursuit of value, ensuring that all members will push in the same direction, towards an ever-inflating price for bitcoin. The interests of those who wish to use Bitcoin for its stated purpose as a payment system do not have representation based on the default design of the system’s control structure.

By considering Bitcoin’s fully centralized control structure, we can better understand its true nature. The goal of Bitcoin is not to enable micro-payments for the huddled and unbanked masses of impoverished El Salvadorian farmers, nor is it to serve as a settlement layer, and although closer to the truth, its purpose is not to serve as a store of value. Bitcoin is, and will be, whatever it has to be to inflate its value as much as is possible. This goal will be pursued ceaselessly until 1 bitcoin is worth a 21 millionth of the global economy, effectively replacing capital as a proxy for wealth in society. It is intended to be a proxy for all resources in the real economy, and as such, the ultimate goal is to tie everything to Bitcoin by whatever means necessary.

This is not a secret; the proponents of Bitcoin openly wish for its ascendance over all forms of fiat currency. It is an irony that bitcoin itself is a form of fiat, issued and controlled by anonymous and unaccountable parties who control and own a system that represents only their interests. Bitcoin’s supposed decentralized functionality is used as an anchor for legitimacy and a justification for this desired supremacy, ignoring the fact that the control of Bitcoin is more centralized than the existing central banking system it purports to replace.

Bitcoin claims to be free of trust, yet there is much that we must take on faith. We are asked to trust the Miners with their veto power. We are asked to trust the opaque exchanges to be free of self-serving corruption. We are asked to trust early adopters and majority coin holders not to profit at the public’s expense. We must trust the words of Nakamoto, and a system whose nature conflicts with them.

Control

Wealth built atop these systems is unassailable

Central banks in democratic societies, for all their deep structural flaws, must represent the interests of all, even if it is to a minimal extent. The control structures which operate central banks, known as governments, have an interest in ensuring that the societies they govern are productive and stable. The mechanism of quantitative easing, or printing money, is not just a financial measure to stimulate the economy, it is better understood if its role as a tool of political power is considered.

Quantitative easing allows governments to exert pressure on private special interests and force them to be more productive. If a private special interest controls 5% of the resources in an economy, then doubling the money supply will reduce their percentage of resource ownership by half. To maintain their 5% stake and position, private interest must do work, and produce utility for the economy. Doing work, however, is hard, and it is better to own 5% of an artificially scarce resource and never have to do any work, or provide any utility, while being able to maintain your position of wealth and power.

It is for the same reason that in the present economic system we observe collusion between financial institutions and powerful corporate special interests, so that when the money supply is expanded, the majority of capital (our existing proxy for resource ownership) is diverted to stock buy backs and corporate mergers. This practice impoverishes the public by reducing the total percentage of resources they control in the economy. It is an abuse of power and a deeply corrupt practice. This misuse occurs because the CONTROL of our financial system is not sufficiently decentralized (democratized).

Decentralizing the financial system’s functionality and replacing existing control structures with even more centralized and unaccountable ones will make the issue of corruption worse. We will gift ourselves a financial system where every remnant of transparency will be extirpated, private interest will rule, and even the faintest memory of a common interest will disappear.

Monetary expansion is the control mechanism that Bitcoin, and other cryptocurrencies, wish to absolve themselves of. Without this check on the power of special interests, they can be less efficient, less competitive, and produce less utility for society. Therefore, cryptocurrencies place ownership above the production of real utility, as the removal of democratic control over the money supply, coupled with an asymmetric distribution of an artificially scarce resource that determines resource ownership, creates a feudal power structure that protects the wealth of special interests. The ultimate goal is not to produce useful products or systems, decentralized digital functionality is inefficient for this purpose, it is to guarantee that the wealth built atop these systems is unassailable and cannot be redistributed.

Taxation can be difficult, special interests can hide their wealth or lie regarding the resources they have at their disposal, this is to say nothing of tax loopholes which are secured by way of legalized bribery of public officials. Monetary expansion, when used judiciously and not as a means of enriching special interests at the expense of the populous, can serve as a powerful mechanism to decentralize control of our economic system, as it can force concessions from special interests without requiring their consent to taxation. It is a form of coercion which can be justified if it is used in the common interest.

Other mechanisms can fulfill a similar function, for example, a demurrage fee on large pools of idle capital could help to increase the velocity of money inside our economy and stimulate the productivity of corporations. Moreover, tying the minimum cost of labour to the amount of capital circulating in the economy could help to ensure that quantitative easing does not disproportionately benefit special interests. A discussion concerning the various potential mechanisms used to decentralize economic control lie outside the scope of this article, I simply wish to point out that these mechanisms are important, and they are the ones that Bitcoin and other cryptocurrency projects seek to prevent or eliminate.

Bitcoin vs. Corporations

Bitcoin is without equal in its ability to advance self-interest

Our corporate system has similar centralized control structures to Bitcoin’s, but they differ in very significant ways. Corporations align the self-interest of a group of individuals to the pursuit of value just as Bitcoin does. Unlike Bitcoin however, they are required to be productive and are constrained by the legal framework in which they reside. Citizens, or customers, can align their self-interest to that of a profit seeking special interest only in specific ways that are governed by the legal framework present in society. The act of becoming an employee, or a shareholder of a company are specific processes which entail legal protections and regulations.

Corporations represent private special interests and although their control is highly centralized, some control is decentralized in that elected officials, who are accountable to the public, create rules which govern their operation. The inherent conflicts of interest caused by lobbying and corporate malfeasance are well known, but overall, the legal constructs known as corporations are legitimized through the consent of the governed. Bitcoin by contrast has no such frameworks to police its excesses and the private special interests represented by Bitcoin are unaccountable and anonymous. The Kings who rest atop a feudal pyramid control the system.

A more subtle difference between corporations and Bitcoin is the way in which Bitcoin can align the self-interest of Users.

Outside of specific legally defined relationships, an individual’s self-interest is not aligned with corporate special interests. The self-interest of the corporation is aligned towards the pursuit of value, but my own self-interest is aligned to whatever utility I am seeking by consuming their product or service. I buy apples because I am hungry, or intend to make a pie, and not because I am interested in turning a profit. If my interests turn to selling apples or pies for a profit, then my desired utility is once again different to those who purchase my goods. In economic exchanges between buyers and sellers, self-interest is unaligned as each party desires different utility. If our self-interest is aligned, then we are either colluding or competing. It is worth noting that the act of buying the pies I produce, adding nothing of value, and then attempting to sell them for a higher price would be referred to as speculation.

In a typical economic exchange, I am seeking the utility of a good or service in exchange for the utility of value. As no real utility is returned, with Bitcoin I donate value in exchange for a promise that the value of a bitcoin will increase. If it wasn’t for the complete absence of legal oversight and economic utility, I would argue this is similar to an investment in real estate or stock.

Bitcoin is unique, in that its structure allows for the unconstrained alignment of self-interest with the special interests who control the system. Bitcoin consumes capital in the real economy and replaces it with a desire to increase the price of bitcoin. Even compared to our modern-day corporate structures, Bitcoin is without equal in its ability to advance self-interest, it is the purest form developed in the history of our species.

Worship in the Pyramid

An effective competitor to the State for societal power

Observers frequently describe Bitcoin’s structure as a pyramid, but Bitcoin differs from a ponzi scheme in that it combines financial interests with a fervent belief that decentralized functionality is equivalent to decentralized control. This faith, along with anti-establishment rhetoric, and a powerful creation myth, form Bitcoin’s holy trinity. The usual cast of evangelists, hucksters, and sectarians have moved in quickly to sell their own forms of worship to the masses of true believers. Crypto authorities and their congregations cannot tolerate doubt, heretics and apostates must be denounced or suppressed, least their skepticism infect the flock.

Almost 50 years after the specification for TCP was drafted, we have the strange honour of being the first in history to witness the development of a religion rooted in digital networks. Should fortune prevail, future Cryptologians may debate the interpretation of RFC 675 in the “Old Testament”, and priests will begin their sermons with “A reading from the Book of Nakamoto…”, one can only wonder how Vint Cerf feels about playing the role of Moses.

The utility of value is a powerful driver of human action as it is a logical construct which represents any possible desired utility. Combined with decentralized zeal, clerics and con-men collude and go to extraordinary lengths to preserve and extend a system which benefits them. This system of belief is being widely evangelized and conversion of those in control of our political and economic systems is especially prized. Once the self-interest of those in positions of power is aligned with the interests of Bitcoin, there exists a grave risk for conflicts of interest, as instability in our existing social systems is used to proselytize Bitcoin as a cure-all for civilization’s woes.

Will those whose interest lay in a competing system be tempted to sabotage the ones they govern? History and human nature would indicate that this is likely. We should be wary of public officials whose financial interests discourage them from enforcing the separation of Church and State. The alignment of self-interest to a religion over the common interest of all citizens is a well-known threat to democracy, and as we have seen with cults such as Scientology, the combination of financial exploitation and faith can result in organizations that are extremely resistant to collapse.

Democratic governance is fundamentally incompatible with existing cryptocurrency systems as they can only represent the interests of those in control of the system. This perpetual motion machine of self-interest is far more reminiscent of a Nation’s ability to align the interests of its citizens, and despite the real dangers to democratic systems of governance, Bitcoin is increasingly an effective competitor to the State for societal power.

Therein Lies the Rub

The digital personification of corruption

Bitcoin performs a bait and switch. If legitimacy is gained through consent of the governed, then Bitcoin claims that no consent is needed because its decentralized functionality means there is no central authority. The truth however, is that decentralized functionality conceals centralized control by a group of individuals who have a singular purpose. Worse still, unlike existing systems of control in our society, cryptocurrencies like Bitcoin have no public accountability, representation, or rule of law. Advocates may insist that the rules which determine the functioning of the protocol are open. But if the only laws that can be made are for the benefit of Kings, then Bitcoin is a tyranny, and those who promulgate its spread wish us to be serfs.

No crime or externality is too great; as long as the sacrifice is made at Bitcoin’s alter, then bribery, ecological harm, or disinformation are all justifiable means to an end. When power advances private over public interest we say that it corrupts. A technological system devoted to the unrestrained advancement of private interest above all other considerations is then the digital personification of corruption. Bitcoin is an ethical regression which claims the divine right of Miners, early adopters, and the Creator(s) to rule.

Other popular consensus mechanisms, such as Proof-of-stake, do not provide guarantees that control is decentralized as token ownership is centralized among early adopters and, at best, acts as a proxy for the existing unequal distribution of wealth in the capital based economy. If the control of an ecosystem is in the hands of individuals who wish to inflate a token to the highest possible value, then that is the interest that will be advanced, and no other interests will be represented unless it supports the system’s prime directive, and serves the self-interest of those in control.

It is not enough to observe from the sidelines, mock Bitcoin or it’s adherents, and think ourselves better than those who have been exploited. Active resistance is needed to prevent the dismantling of existing decentralized control structures. The installation of systems that favour centralized control and zero accountability are a risk to existing democratically governed institutions. Moreover, we must challenge the deeply held religious belief that because a system’s functionality is decentralized, that it is not centrally controlled. A group of individuals who act in concert and whose self-interest is aligned are no different to any other special interest.

The core issues that I raise with Bitcoin are present in all public permissionless cryptocurrency systems as existing projects are, to my knowledge, centrally controlled. While private permissioned blockchain projects can efficiently provide utility, any ecosystem that depends on inflating the price of a token is susceptible to centralized control. A digital ecosystem which mediates exchanges and facilitates the production of economic utility should be designed to represent the interests of all participants. Different paradigms are needed if we wish to accomplish this goal and constrain the natural pull of self-interest inside digital systems.

Building Better Systems

Distributed or decentralized functionality can be useful, but its implementation can also come with serious drawbacks in terms of performance and efficiency. Moreover, if it is coupled with centralized control, we obtain the worst of both worlds. Centralized control of public goods combined with no accountability will inevitably lead to corruption, as a result, a system’s stated goals will differ from its actual goals. If we wish to create digital systems that can remain true to their stated goals, and represent the interests of all participants in the system, then we must look at ways to decentralize control through technological and other means.

Bitcoin’s blockchain enforces a feudal ownership system, however, the property of immutability can be repurposed by technologies that provide tamper evident records to enable radical forms of transparency that assist in the decentralization of control. Digital ecosystems need mechanisms to enforce the censure or expulsion of special interests who exploit other participants. Communities should not be required to fork projects and start from scratch if control, and common infrastructure, falls into the hands of bad actors.

Above all else, organizational structures which guarantee neutral governance are needed in order to ensure representation amongst participants conducting economic exchanges. As a system’s functionality becomes progressively more centralized, so too does the requirement for stronger democratized (decentralized) control mechanisms. The functionality we create matters, but the governance systems we use to decentralize control matter more.