The Strange Case of Nakamoto's Bitcoin - Part 1

“There's an old saying in Tennessee—I know it's in Texas, probably in Tennessee—that says, 'Fool me once, shame on… shame on you. Fool me—you can't get fooled again."

George W. Bush, Nashville, Tennessee, September 17, 2002.

Shams, Shakedowns, & Swindles

When I read through the list of confidence tricks on Wikipedia I’m struck by the boundless creativity that humans posses. I imagine the millions of variations of scams and schemes that must have existed over the lifetimes of 100 billion people, and marvel at our ingenuity when it’s applied to making a quick buck.

From papyrus to protocols, the undiscovered country of criminality lies along the frontiers of new technology. Ethical borders are easily crossed, and moral compasses ignored, when opportunity is plentiful and law is scarce. Outright theft has always been relatively straightforward, but risky. Why take by force what the gullible and guileless will volunteer? Patience is a virtue, and the long con is where the big money is at.

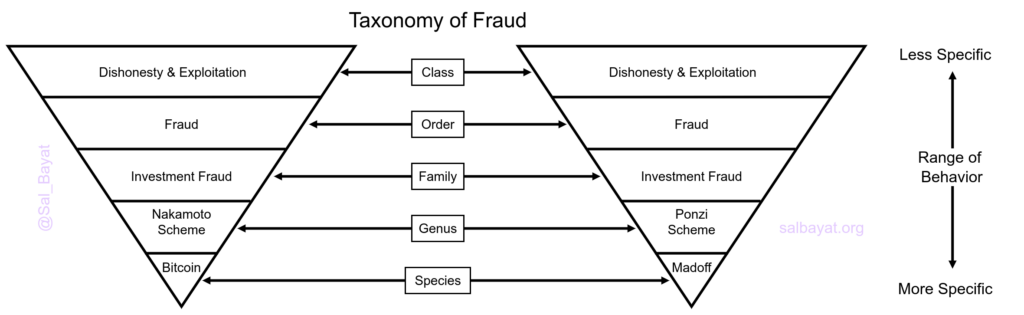

Fraud’s foundations lie in the marriage of dishonesty and exploitation. Beyond this, its taxonomy is arbitrary. Many choose to assign fraud to a category based on the specific goal or mechanism used, while some experts suggest classification which first considers group or individual targeting. Whatever our system, the limits of categorization quickly become apparent. Some schemes target groups and individuals simultaneously. Many scams borrow generously, their methods and mechanisms bleeding into one another, making them hard to pin down. Categorizing fraud is an attempt to define the scope and range of all possible human behavior which uses deceit to exploit others for personal gain. As a result, fraud’s internal boundaries can be unfocused.

While sometimes difficult, general categorization does help to provide clarity, specific instances of fraud are carefully examined and grouped based on their modus operandi. Occasionally new groups are discovered and given names like ‘Payroll Spoof’ or ‘Ransomware’. It is by dissecting specific species of fraud that new genera are discovered in the wild.

Using this approach, we can think of the Madoff investment scam as a specific species of fraud which belongs to the genus Ponzi Scheme. The Ponzi genus belongs to the family of Investment Fraud, which also contains the genus Pyramid Scheme. Members of the same family are distinct, but often share similar characteristics and mechanisms. We could say that the Madoff and Amway schemes are related, as their genera are both members of the Investment Fraud family.

As Bitcoin, and cryptocurrencies in general, claim to be investments, yet have no underlying sources of revenue, many have viewed them with suspicion. Some argue that Bitcoin is a Ponzi, while others counter that the comparison is erroneous as it shares traits with a pyramid scheme. Surprisingly, despite intense scrutiny, Bitcoin has defied precise categorization as a specific form of investment fraud, leading some proponents to suggest that, as a result, it should be cleared of all charges, “If it looks like a duck, but honks like a goose, then it can’t be either”.

In actuality, categorizing the mother of all crypto as Ponzi or pyramid is an attempt to fit a square peg into a round hole. Bitcoin is neither, it belongs to a new genus of fraud. It has several specific qualities that make it unique, and many others that it shares with known forms of investment fraud, notably Ponzi and pyramid schemes. By carefully examining Bitcoin’s construction and observing its relations with other forms of investment fraud, we can better understand the inner workings of the Nakamoto scheme.

Odd Duck

Like a Ponzi, Bitcoin doesn’t specifically promote a need for liquidity or sales. Like a pyramid, Bitcoin promotes, proselytizes, and preaches as realizing returns is dependent on new converts.

Like a Ponzi, Bitcoin doesn’t sell the rights to acquire new members or sell products. Like a pyramid, the right to sell something can be purchased, the ‘investment’ made during the mining process bestows Miners with the the right to sell the bitcoin they acquire.

Like a Ponzi, a Bitcoin investor’s returns don’t depend on their direct recruitment efforts. Like a pyramid, a Bitcoin investors ability to realize returns depends on transactions with counter-parties recruited into the scheme.

Like a Ponzi, Bitcoin guarantees returns to investors. Like a pyramid, Bitcoin investors entirely depend on recruitment to realize returns.

Bitcoin is a strange amalgam, and can best be described as an extensible sub-fiat distributed virtual investment fraud hybrid, more easily referred to as a type of Nakamoto Scheme.

It is extensible because Bitcoin is a digital network and can be used as a scaffolding onto which other forms of investment fraud can be grafted (Ponzi, Pyramid, Pump and Dump). It is sub-fiat, in that the initial investment in the scheme is not made with dollars, but with a commodity, as electricity is wasted during the mining process, giving the scheme a naturally occurring fiat on-ramp and valuation mechanism. It is distributed, as the mining process creates a level playing field, a fair market, where a stake in the scheme can be purchased. It is virtual, in that the scheme provides virtual returns which can only be realized via fraud which enables additional fiat on-ramps. It is an investment fraud hybrid, in that it shares many of the same characteristics and mechanisms that are found in related investment frauds.

We’ve known for some time that Bitcoin resembles other types of investment scams, so let’s take a look at what qualifies the Nakamoto scheme as a novel form of fraud.

Growing the Flock

Up until 2009, fraud could be conducted over digital networks, but Bitcoin is the world’s first case of investment fraud which is a digital network. Because participants and software can interact with the network, new systems can be created which allow the extension of further schemes.

Centralized exchanges can be built which enable more traditional forms of financial schemes. Exchanges can leverage insider information, or wash trade to manipulate prices, or can front run clients to liquidate leveraged positions. It is even possible conduct unregulated fractional reserve crypto-banking by selling synthetic bitcoin to customers.

Typically con-artists prefer to keep their schemes to themselves, but allowing others to build on top of Bitcoin helps to legitimize the scheme and attract liquidity from a wider audience.

Taking Wing

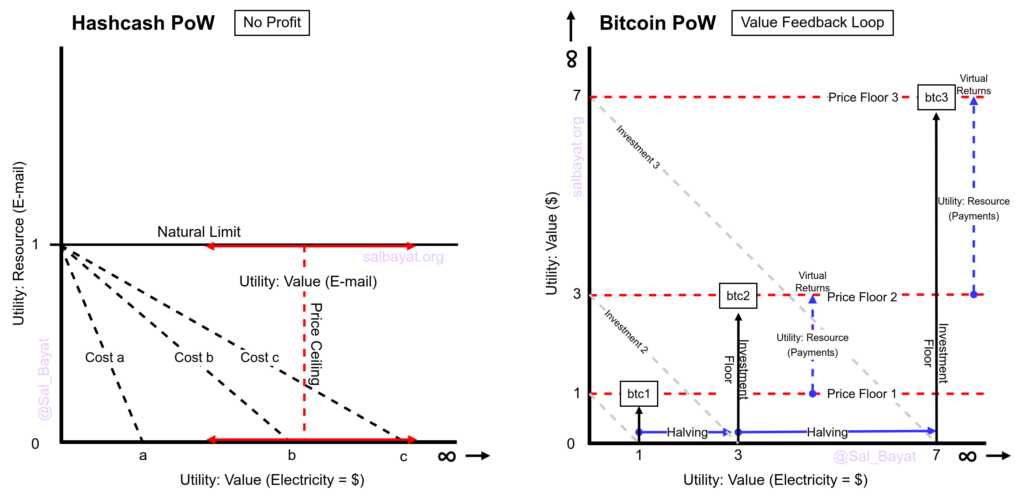

The most important, and most novel mechanism in the Nakamoto scheme is the way in which Proof-of-work (PoW) is leveraged and combined with mining rewards. Originally, Hashcash’s PoW was proposed as a way to discourage e-mail spam or denial of service attacks by forcing senders to expend CPU time, and hence electricity. Electricity costs money, and while the cost is small, it will scale with the number of emails sent, or connection attempts made. This method of using PoW explicitly ties it to some type of utility being provided. In contrast to the ethical ethos of hyper-financialization found in crypto, this method was preferred to email micropayments as it avoided the administrative and moral issues related to charging for e-mail.

In it’s original form, PoW expends electricity, but the value of that wasted electricity is a cost required to provide utility. Because the goal of this system is to provide some good or service (resource), a price ceiling is established based on the subjective value of being able to send an email.

Nakamoto’s genius lay in realizing they could hijack proof-of-work to kill four birds with one bitcoin.

Bird 1 - The Investment Vehicle

Firstly, Nakamoto inverted Hashcash’s PoW. Instead of being used to provide utility, the electricity expended by PoW could be tethered to the value of a digital token by a reward mechanism. In Nakamoto’s incarnation, participants have a chance to receive a reward in the form of bitcoin by conducting PoW calculations. This process is referred to as mining, and it transforms the expenditure demanded by PoW from a cost into an ‘investment’ in the mind of the Miner. To participants, the bitcoin they mine has intrinsic value equal to the amount of money spent to mine it (electricity + capital + other operating costs). This gives the token a concrete value for everyone who participates in the mining scheme, and creates the foundations for a market by providing a universal valuation mechanism.

As it does not concern itself with providing utility, Bitcoin’s only goal is value. A price floor is created based on the amount of electricity used to generate a bitcoin. To realize returns, Miners must exchange the tokens for a greater amount of value than the cost of electricity used to generate them. Instead of PoW being used to provide a good or service, what we might call a resource, it’s purpose is inverted to transform a cost into an investment. To those who have been lured into mining, the ‘value’ of this investment is equal to the cost of electricity that they have used to generate the token.

Real economic exchanges involve the transfer of value for the utility of a resource, we give the baker money and in exchange receive our daily bread. Real investments are expenditures, where we exchange value for something that will possibly return a greater amount of value to us in the future. With investments we are purchasing the utility of possible future returns. Real Investments can be considered assets because they have mechanisms which can generate positive economic output, these mechanisms exist within a legal framework which defines them and enforces rules about their operation. If you remove the legal framework and all mechanisms for generating positive economic output, then what you are left with is not an asset. If value is exchanged in an economic transaction, but no good or service (resource) is returned, then no utility can be derived as there is no resource to consume.

All investment frauds attempt to change the nature of economic interactions from ones that trade value for the utility provided by resources, to ones that trade value for value. Traditional schemes will seek to camouflage this subversion of utility and removal of revenue generation by hiding the fact that there are no underlying mechanisms that generate positive economic output. We see this in the case of Ponzi and pyramid schemes.

For Bitcoin, external camouflage is unnecessary as its inversion of resources (provided utility) for value in proof-of-work means the system is premised on the exchange of value for value. However, from the perspective of those participating in the scheme, Bitcoin is a logically consistent economic system as participants believe that the act of wasting electricity is a resource which provides utility, this resource is then exchanged for value by way of mining rewards. Within the belief structure of the system Miners are like a business whose ‘investments’ fund the production of resources. The protocol then exchanges value (bitcoin) to the Miners for the resource they produce.

Miners view what they produce as a resource which they exchange for value, however, because Bitcoin’s PoW is inverted, in the real world, Miners produce an externality, wasted electricity which amounts to an economic and environmental cost, just as it does in the Hashcash implementation.

In a Ponzi scheme, the more you invest, the greater your potential returns, investors are limited by the amount of money they have to contribute. In a pyramid scheme, the more you work to recruit, the greater your potential returns, investors are limited by the amount of work they can do. The Nakamoto scheme is unique in that its PoW implementation produces a blend of psychological elements from both schemes. Potential returns are only limited by the amount of money Miners put to work, the scheme can appeal to their greed, as well as depend on a sense of entitlement to their returns as they have ‘worked’ for them. The Nakamoto Scheme achieves the best of both worlds, it produces the psychological buy-in we see from pyramid schemes and creates a ponzi like investment structure that is less constrained as it benefits from indirect recruitment.

By creating an automated system that tethers a representation of value (bitcoin) to the value of electricity expended through PoW, the foundations of a fraudulent investment scheme are born.

Bird 2 - Stake Ownership Distribution

Secondly, Nakamoto combined bitcoin rewards with PoW to create a distributed scheme. Running a distributed confidence game has many benefits but it also poses problems. Sharing profits in the scheme helps to legitimize it and produce a network effect. This greatly increases the reach of the scheme, which results in greater total liquidity invested into it, and as a consequence leads to greater returns extracted by co-operators. Trust is an issue though, and the creator of the scheme needs a way to place themselves on even footing with potential co-operators. Understandably, potential participants are less likely to trust in the scheme if up front demands for money are made.

Please note that I have settled on the usage of the word stake instead of ownership because, bizarrely, Bitcoin does not actually have a concept of ownership as we typically understand it. Miners gain initial custodial ownership of a bitcoin, but the only right that is granted by this ‘ownership’ is the right of sale. All other rights typically afforded to owners are missing.

Instead of investing by giving money to a centralized authority, interested parties are asked to waste resources as a proxy for investment. By requiring the consumption of a commodity to buy in on the ground floor and acquire stake in the scheme, Bitcoin is able to create a fair playing field as the PoW mechanism does not favour a particular participant. This is an ‘honest’ way of determining stake in an open investment fraud. As no central operator is taking the money invested, the stake acquisition process is more trustworthy and attractive to potential co-operators.

If I wanted to distribute stake in the analog world it would be much more difficult to provide a level playing field. I could provide a way to certify that co-operators set fire to fiat currency, and then match their ‘investment’ by compensating them with an unforgeable coin equal in value to the amount of fiat burned. However, this system has major drawbacks, as I could collude with investors to fake the fiat destruction, or some participants might attempt to use counterfeit currency. Moreover, the process scales poorly, limiting the pool of potential participants.

When compared to an analog equivalent, Bitcoin’s Proof-of-Work and coin rewards are an obviously superior method for creating an open distributed investment fraud, a key requirement for the Nakamoto Scheme.

Bird 3 - Guaranteed Returns

Thirdly, Nakamoto needed a way to guarantee returns to investors. The scheme had an investment vehicle, a way to value the investment, a mechanism to distribute stake, and a fair playing field that could serve as the foundation of a market, but it was missing a hook, the incentive that encourages participation. In Bitcoin, it is the halving schedule for mining rewards which not only promises returns to investors, but actually delivers on them.

Bitcoin has a planned total money supply of 21,000,000 bitcoins and approximately 19 million are currently in circulation. Nakamoto tied coin rewards to the PoW system whose supposed primary purpose is to select a Miner who can write data to a shared ledger. The Bitcoin protocol adjusts its hashing difficulty so that a cryptographically hashed block of data can be written to the ledger every 10 minutes. These blocks of data contain bitcoin transactions.

The Miner who guesses a hash that meets the difficulty requirements is able to write a block of data to the ledger. All other work is discarded by Miners who failed to guess the correct hash. As part of this process, the successful Miner includes an additional transaction where they are awarded a number of bitcoins. This reward acts as an incentive for Miners to conduct the work necessary to maintain the Bitcoin system. In 2009 Miners were rewarded with 50 bitcoin for writing a block to the ledger, however, every 210,000 blocks (around every 4 years) this reward halves, and in 2022, after 13 years, the current mining reward is 6.25 bitcoin.

Proof-of-work creates the investment vehicle, but it is the halving schedule which guarantees virtual investor returns. A Miner who generates 50 bitcoin by using $50 of electricity will value their bitcoin at $1. However, due to the halving schedule, in 4 years, to acquire another 50 bitcoins, the Miner will need to invest $100. As they are fungible, any bitcoin mined before the halving date is mined at a discount. After the halving date passes, the Miner must invest $2 per bitcoin in order to mine them. The Miner has doubled their money in 4 years, equivalent to approximately 19% APY.

After halving a Miner must make twice the investment to earn the same rewards, the existing bitcoin have, effectively, doubled in value. The Bitcoin protocol guarantees these returns. Amazingly, within the context of the Bitcoin system, these returns are real, however, as a non-participant we would refer to these returns as virtual (and fraudulent), as they exist in the native digital token and not as fiat currency.

Moreover, because other Miners have started participating over those 4 years, the hash rate and hence difficulty of finding the correct hash has increased. This means that overtime it has become more expensive to earn a bitcoin, meaning that it is possible that your investment has more than doubled after halving. The halving doubles the value of a bitcoin at the time the halving occurs. Referencing our earlier example, if the Miner had invested $1 per bitcoin mined, but just before halving it took $4 of electricity to mine a bitcoin, post halving, the value of a bitcoin would be $8. The Miner is up 8x on their initial investment.

It should be noted that the combination of PoW, bitcoin rewards, and the halving schedule produce information asymmetries that lead to arbitrage opportunities. Some Miners may be more efficient in their production of bitcoin, leading to slightly different valuations. Moreover, some Miners and speculators may be more savvy in regards to Bitcoin’s true nature and fundamental mechanisms, leading them to acquire bitcoin in anticipation of greater virtual returns.

These guaranteed returns offer an extremely strong incentive to participate in the system as early as possible. However, virtual returns come with a catch. Investors can only realize the returns in fiat currency if they recruit others into the system. This is effectively a halfway point between a Ponzi and a pyramid scheme and is a staggeringly brilliant innovation in deception. Virtual returns that can only be realized if fiat liquidity is recruited into the fraud. The Nakamoto scheme is a masterpiece, and its creator a gifted idiot savant, or the Einstein of con artists.

Bird 4 - Realizing Virtual Returns

Fourthly, Nakamoto realized that PoW could be used to provide the utility of irreversible bitcoin ownership transfers, allowing participants to realize virtual returns either by trading bitcoin for goods and services, or for fiat currency. Bitcoin’s distributed append-only ledger allowed Miners to trade their bitcoin to one another, or to speculators, and no double spending meant a fair playing field to realize returns through fraud. This created a speculative marketplace where outside liquidity could be on-boarded into the scheme, the value of a mined bitcoin would not be constrained by the amount of electricity used to produce it. This is the mechanism that enables the ponzi and pyramid like aspects that we are familiar with in Bitcoin and the reason why the scheme is dependent on disinformation, propaganda, and indoctrination, as recruitment is necessary to realize returns.

Have you ever wondered why Bitcoin makes such a poor payment network? Why Nakamoto ignored or sidestepped questions on the transactional performance of Bitcoin and instead would focus on bandwidth? What about the transactional profile of Bitcoin being far closer to something used to register real estate transactions, rather than a global payment network? The answer is clear, transactions in Bitcoin are not meant to facilitate payments in the typical sense, they are useful insofar as they allow Miners and speculators to realize returns on their investments.

A speculative and deflationary ‘asset’ makes for a poor currency, people are disincentivized from using it today, as it might be worth considerably more tomorrow. This very criticism was leveled against Bitcoin on the BitcoinTalk forums in February 2010, as the design of coin rewards combined with the halving schedule rendered the protocol useless as a currency. Few would spend something whose value appreciated 19% every year. Nakamoto participated in this very forum thread and was well aware of the criticism, but shrewdly chose not to address the issue directly, ever careful to misdirect, lest too much attention be paid to Bitcoin’s fatal flaws.

By creating the narrative that these ownership transfers were entirely for payments, that Bitcoin was intended to be a form of electronic cash, Nakamoto was able to internally camouflage the true purpose of PoW and Bitcoin, the creation of a new form of investment fraud driven by speculation, and dependent on outside transfers of value in the form of fiat liquidity to realize virtual returns.

Quoth the Raven

Bitcoin is not a form of electronic cash. Bitcoin is not a store of value. Bitcoin is not a hedge against inflation. Nor is it digital gold, the future of finance, or an investment. Bitcoin is a type of Nakamoto scheme, a form of investment fraud which leverages an unsound economic premise to enable transactions where no utility is exchanged. The scheme is characterized by several unique properties:

The tethering of a speculative digital token to a cost in order to create the illusion of an investment.

The creation of a mechanism which can distribute stake in the scheme so that there are multiple co-operators instead of a single operator, i.e. a distributed open investment fraud.

Virtual investment rewards are delivered to co-operators, these returns are not fraudulent to participants operating within the system’s context (to an outside observer they are fraudulent returns).

As the scheme provides no underlying mechanisms to generate revenue, virtual returns can only be converted into real returns if participants become co-operators in subsequent investment frauds which enable the inflow of fiat liquidity. A built in mechanism which allows the transfer of the digital token is used to convert virtual returns into goods and services or fiat currency.

These properties can be used to distinguish the scheme from more traditional forms of investment fraud like Ponzi and pyramid schemes.

Proof-of-Stake

Bitcoin inverts resources for value with proof-of-work to enable a new form of investment fraud; however, proof-of-stake (PoS) also enables value for value exchanges. Although PoS systems are not sub-fiat and provide a less robust fair playing field to distribute stake, they are a more efficient, though less deceptive, form of Nakamoto scheme. PoS allows a scheme to more effectively provide access to fiat liquidity, not only can we do away with an expensive stake distribution process, but there is no need to wait for the organic growth of subsequent investment schemes which provide exit liquidity for co-operators.

‘Investors’ provide seed money to an organization in exchange for tokens which guarantee virtual investment returns (fraudulent returns) by way of a staking mechanism. This organization is then delegated with certain responsibilities. It is tasked with creating promotional materials, such as a whitepaper, purchasing advertising, handling media relations, and creating some amount of demonstrable functionality. Although the system will provide some form of functionality, due to the performance limitations of distributed append-only ledgers, this functionality will never be able to compete with existing in-market solutions, and hence there will never be a source of significant revenue which can compensate investors for their initial allocation of funds. No resources, and hence no provided utility, are being exchanged for investor value.

The true purpose of this organization is not to create a product, but to promote their scheme to potential victims and work with existing scams like cryto exchanges, in order to provide exit liquidity for their investors. As these centralized entities are doing a great deal of the heavy lifting to provide exit liquidity, we would expect that they would take a greater percentage of the profits and, as a result, we would expect to see more centralization in terms of token distribution (higher gini coefficient) in proof-of-stake systems vs. proof-of-work systems like Bitcoin or Ethereum.

Proof-of-Stake crypto systems are a type of Nakamoto scheme as they fulfill all of our criteria, with slight modifications in that they provide a less robust but more efficient stake distribution mechanism, and centralize the development of subsequent investment frauds to enable inflows of fiat liquidity.

Crash Landing

The Nakamoto scheme is substantively different than a Ponzi or pyramid scheme and far more deceptive. It leverages digital technology to create a form of economic disinformation which weaponizes investment fraud. Tethering cost to a speculative digital token, which guarantees virtual returns but does not provide utility, is a fraudulent act that should be banned. All systems which enable value for value transactions, where no underlying utility is provided in the exchange, drink from a poison chalice.

The most dangerous lies are the ones that we want to believe, and from alchemy to airdrops, the fantasy of getting something from nothing to get rich quick is commonly pressed into the service of exploitation. This lie is so powerful that when a stranger holds it up to us as a promise of freedom, we are willingly deceived, careful to avoid peering too closely at what lay beyond the curtain of our own self-interest. Instead we coat and varnish the ugly truth until it gleams, its dark heart hidden even from ourselves. The cryptocurrency industry is rotten at its core; based on a carefully orchestrated deception, it cannot serve as the basis for rational economic exchanges.

Freedom is only possible where rights have space to exist, and for a technology that brands itself as the personification of liberty, Bitcoin is devoid of substance. This absence does not stem from a lack of regulation, it is that Bitcoin does not contain anything that can be regulated. There is nothing here and no room for freedoms, except the right to sell a bitcoin. Hot air and hype cannot serve as the foundation for an economic system, and the creation of rules within the context of an investment fraud is madness.

Bitcoin uses a corrupted implementation of proof-of-work to recruit co-operators into an investment fraud and distribute its function. It creates an investment vehicle in the form of a speculative digital token which guarantee returns. The delivery of these virtual returns incentivize recruitment of fiat liquidity into the scheme, as the only way to realize profits is to find a greater fool. These mechanisms align the self-interest of participants, and this alignment serves as a powerful force that ensures all co-operators act in concert to increase the value of a bitcoin by as much as is possible and extend the fraud to the furthest reaches of our civilization.

Using cryptographic hashing techniques to create an append only ledger is not in and of itself exploitative. However, creating a mechanism that enables economic transactions where value is exchanged for value can only serve as a vehicle for fraud. Bitcoin and all cryptocurrency systems as they exist in their present form are examples of harmful technology. They are dangerous and should not be allowed to exist. Value must be tied to the utility provided by a resource, and not to deception or an externality. By defining the unique characteristics of the Nakamoto scheme, we are better positioned to identify them so that we may act accordingly when they are encountered.

As it turns out, “If it looks like a duck, but honks like a goose, then it’s probably related to both”.

To be continued in The Strange Case Of Nakamoto’s Bitcoin – Part2

An examination of the common properties observed in the Investment Fraud family.

My articles and research will always be free of charge.

If you’d like to support me, please use the links below.

This is a very thoughtful article but it is based on a variety of fundamental errors. The most fundamental error being:

> Have you ever wondered why Bitcoin makes such a poor payment network? Why Nakamoto ignored or sidestepped questions on the transactional performance of Bitcoin and instead would focus on bandwidth?

This is completely false and based on the false comparison of payment card transaction approval time versus Bitcoin settlement time. Both Bitcoin (as it originally functioned, prior to the 2017 Segwit/LN reengineering scheme) and payment cards can approve a payment in a matter of seconds. In both cases payments have been seen by the network and payment is pending. In Bitcoin this is called a “zero-conf” payment, and contrary to the author’s claims, Nakamoto proposed a snack machine design that would accept these transactions. This design was later successfully implemented.

However, whereas payment cards typically take several weeks to settle (become irreversible) Bitcoin transactions typically take 10-60 minutes to reach irreversibility.

Once this fundamental misunderstanding of Nakamoto’s invention is properly understood, many other of the author’s claims subsequently fall apart, for example the claim that Bitcoin cannot function as digital cash. In fact Nakamoto’s entire design was proposed as a digital cash system. The reason he focused more on the topic of bandwidth was because that was the question he was most pushed to explain — since it clearly functioned very well as cash per the original design laid out in the Bitcoin white paper. People didn’t ask him to defend its usage as cash because it clearly already worked fine as cash.

The author would do well to learn the history of how the Bitcoin project became corrupted. It is there that Nakamoto’s Achilles heel can be found. Bitcoin (BTC) no longer functions well as cash, but that is because it was profoundly reengineered from a cash system into a settlement system circa 2016-2017. See Jeff Garzik’s article “Bitcoin is Being Hotwired for Settlement.” After this, Bitcoin lost its fundamental value proposition, namely: allowing any two willing parties to make casual cashlike transactions in the bearer asset with no need of an intermediary. At this point the project’s cheerleaders pivoted from a payment system to a “store of value” system, despite the fact that “value” cannot be stored. Only the coins can be stored. Value is only realized at the moment of exchange.

The “hotwiring” of Bitcoin into a settlement system is a long and sordid tale involving character assassination, massive online social media manipulation, and a lot of VC from the legacy financial system.

The original Bitcoin project as envisioned by Nakamoto continues today as Bitcoin Cash. There you will discover that in fact transactions are approved as fast as a credit card with no need of third party processor and with fraud rates an order of magnitude lower than cards. This is a system which has direct utility, because it enables people to electronically transact at the merchant level without intermediaries. Disintermediation is value.

I would recommend visiting the community located at reddit.com/r/BTC to learn more about what happened to Bitcoin.

This argument is based on revisionist history of Bitcoin. The desire to propagate Bitcoin to as many participants as possible as warped people’s views of early Bitcoin history. The fundamental flaw of using a coin with ever increasing purchasing power for payments was not added in 2016, it has been present since the inception of the protocol. In fact, it was called out in February 2009 by Sepp Hasslberger – http://p2pfoundation.ning.com/forum/topics/bitcoin-open-source?commentId=2003008%3AComment%3A9578

Bitcoin could never be used as a payment network, and Nakamoto gave the reason for this in that same thread:

“As the number of users grows, the value per coin increases. It has the potential for a positive feedback loop; as users increase, the value goes up, which could attract more users to take advantage of the increasing value.”

Nakamoto created a protocol that artificially creates a positive feedback loop by demanding more value (increased cost) as participation increases. Nakamoto acknowledged that this is what they were trying to do. Then Nakamoto left the project within a few weeks of the positive feedback loop beginning, as evidenced by the hashrate spike in March/April 2011. You can check that yourself if you like.

Discussions of settlement times and bandwidth considerations were always intended to distract from the fatal flaws preventing Bitcoin from being used as a payment network. The focus was always on propagating the network to as many participants as possible. You may be surprised at what you discover if you carefully read through Nakamoto’s statements.

“By creating the narrative that these ownership transfers were entirely for payments, that Bitcoin was intended to be a form of electronic cash, Nakamoto was able to internally camouflage the true purpose of PoW and Bitcoin, the creation of a new form of investment fraud driven by speculation, and dependent on outside transfers of value in the form of fiat liquidity to realize virtual returns.”

We have come so far that the takeover of blockstream and the subsequent change of the narrative is now blamed on Satoshi himself. Satoshi always spoke out for sound p2p cash. The use case of easy transferable unstoppable money was the base for Bitcoins value.

You should go to the right people when you hand out accusations. Adam Back and blockstream.

The purpose of this article was not to address the block size debate or subsequent malicious intent, it was to discuss the fundamental design of the protocol itself by its Creator. As such, Nakamoto is responsible for what they created, whether Bitcoin’s functioning as a form of investment fraud was intentional or an emergent phenomenon is debatable, though my thoughts on the subject are obvious.

I find this an interesting, but in may ways, a misleading analysis. May I temp you to take the same approach to analysing the Euro or US dollar, and critically examine how they are created and ascribed ‘value’ ?

The point of currency is not to be used as a speculative investment. That shouldn’t need to be explained. We want currency to be spent and its purpose is to incent productive economic activity, its purpose is not for you to acquire $100,000 and be able to hoard it like a dragon, never spend it, and live off its interest, never having to do another day’s work in your life. Do you see how that would result in unproductive economic systems?

Moreover, there exists inelastic demand for fiat currencies in that their use is mandated by the state. The taxes that you pay, which create the civilization you see around you, as well as the infrastructure that lets you post this comment to this website, mean that there is always a demand for fiat currency.

You constantly assert that some quality of bitcoin makes it fraudulent and provide few actual arguments of what classifies it as fraud except “likeness” to other frauds. I think you incorrectly identify the fraudulent qualities of the frauds you are comparing bitcoin to and make the mistake that if ANY aspect of bitcoin can be related to a known fraud, bitcoin is a fraud. I encourage you to try a different method of arguing your claim, maybe start from the definition of fraud and see if bitcoin fits that definition. Likeness is not a fool-proof argument method.

” By carefully examining Bitcoin’s construction and observing its relations with other forms of investment fraud, we can better understand the inner workings of the Nakamoto scheme.” This I suppose is your thesis statement.

“Like a Ponzi, Bitcoin doesn’t sell the rights to acquire new members or sell products.” You just ascribed a negative quality to bitcoin and said thats what makes it like a ponzi. I could also say, like a watermelon, bitcoin does not have any bones in it. Is bitcoin a type of watermelon? You make these negative assertions at least three times in the Odd duck section.

” Like a pyramid, Bitcoin promotes, proselytizes, and preaches as realizing returns is dependent on new converts.” First off, the alliteration is cute but unnecessary and distracting because these are all just three synonyms, (just like the shams, shakedowns and swindles) it is logically equivalent to saying bitcoin promotes, promotes and promotes. Realizing returns is dependent on new converts: You need someone to sell to in order to make money on this, sure. This is a corollary of the fact that bitcoin does not have revenue or earnings. Gold also does not have revenue or earnings, and as such an owner of gold depends on “new converts” (AKA a buyer, they dont really have to be a new, or a ‘convert’) in order to realize a return.

Bird 1: your discussion of “value for value” being a fraud and confusing juxtaposition of resource utility and value and producing wasted electricity is very unclear. See: “participants believe that the act of wasting electricity is a resource which provides utility, this resource is then exchanged for value by way of mining rewards. Within the belief structure of the system Miners are like a business whose ‘investments’ fund the production of resources. The protocol then exchanges value (bitcoin) to the Miners for the resource they produce.”

The act of wasting electricity is a resource which provides utility: An act is not a resource. Electricity is a resource.

This resource is then exchanged for value by way of mining rewards: Yes, electricity is exchanged for bitcoin.

Miners ‘investments’ fund the production of resources: ? Miners fund the production of electricity? Sure, I guess.

The protocol exchange value to the miners for the resource they produce: More directly, the protocol rewards bitcoin for a certificate that proves work has been done. Miners must EXPEND (they don’t necessarily have to produce it themselves) electricity in order to do work (make guesses).

“Potential returns are only limited by the amount of money Miners put to work, the scheme can appeal to their greed, as well as depend on a sense of entitlement to their returns as they have ‘worked’ for them. The Nakamoto Scheme achieves the best of both worlds, it produces the psychological buy-in we see from pyramid schemes and creates a ponzi like investment structure that is less constrained as it benefits from indirect recruitment.”

No, potential returns are limited by the amount of work a miner does. When you say the amount of money a “miner” puts to work, you are referring to proof of stake. This is not a sign of a fraud. Similarly, the potential returns of a job at McDonalds is limited by the amount of work a person does. How is this fraud? You said it was because this is similar to Ponzi/Pyramid, but this similarity does not seem to entail fraudelence.

“Like a pyramid, the right to sell something can be purchased, …” “Bitcoin does not actually have a concept of ownership as we typically understand it.” You are doing mental gymnastics here. I can see you are skirting around saying ‘ownership can be purchased’ because for some reason you have your own definition of ownership that has some undefined qualities you find unsatisfied in bitcoin. Anyways, the fact that something that is purchased can be sold by you does not make it a pyramid scheme. The right to sell a pair of shoes can also be purchased when I buy a pair of shoes. Does that make it a pyramid scheme? Or alternatively, the ‘investment’ made during the iPhone creation process bestows Apple with the right to sell the iPhones they acquire. Is Apple a pyramid scheme? Also, in Bird 4 you say “the utility of irreversible bitcoin OWNERSHIP transfers.” You should clear up this contradiction.

Bird 2 is just you saying why bitcoin is good, “Running a distributed confidence game has many benefits but it also poses problems” and then you proceed to describe no problems at all with it. You say things like “This is an ‘honest’ way of determining stake in an open investment fraud” but that is not an argument why its a fraud, its just you asserting its a fraud. I notice you take every opportunity to slip in the word fraud in every description of bitcoin, as if you are trying to persuade through brute force of repeating the word fraud, without actually making an argument to support this description.

“Like a Ponzi, Bitcoin guarantees returns to investors.” No it doesn’t, and I don’t think anyone thinks that bitcoin is a guaranteed return. In your discussion under bird 3, its clear what you mean by “guaranteed” return is a return in bitcoin-denominated terms for a miner. Fundamentally, this is not guaranteed, as it is absolutely possible that a miner never correctly hashes a nonce and thus never is rewarded any bitcoin. With the introduction of mining pools, this risk is spread through an entire group of miners and this can drastically increase the likelihood of a reward, but it is still possible to, in finite time, never correctly solve a block, and so never be rewarded bitcoin. And also, in your discussion of bitcoin price being set by the cost of electricity, this is not true. The market price is determined by the meeting point of the tension between a buyer looking to pay the lowest price and a seller looking to receive the highest price, the calculation of electricity/hardware/infrastructure costs needed to earn bitcoin via mining is merely a fraction of the seller-side of the equation, and your view completely ignores the demand side of the market-price equation. A miner could lose money on their earned bitcoin if a buyer is not willing to pay so much. This does not make it a fraud, a business endeavor that didn’t yield a profit is not inherently a fraud. Here is what you write about how this makes bitcoin a fraud. “Investors can only realize the returns in fiat currency if they recruit others into the system. This is effectively a halfway point between a Ponzi and a pyramid scheme and is a staggeringly brilliant innovation in deception. Virtual returns that can only be realized if fiat liquidity is recruited into the fraud.” Refer to my example of iPhone production. See my following argument of Apple being a fraud:

Apple can only realize the returns in fiat currency if they recruit others into the system. This is effectively a halfway point between a Ponzi and a pyramid scheme and is a staggeringly brilliant innovation in deception. iPhone returns that can only be realized if fiat liquidity is recruited into the fraud.

You are arguing that a product is a fraud because others need to buy the product in order to make money from it.

Also, your discussion of append-only ledger, irreversible transactions is incorrect. Bitcoin’s consensus method operates by miners collectively choosing to work on the longest chain. If a transaction happens in block 1000 that is universally agreed to be bad, a majority of miners can re-hash block 1000 without the particular transaction and then append a block 1001, 1002, etc. as needed in order to create a new longest-chain. This, of course requires a significant consensus amongst computationally-capable miners, and so using words like irreversible and append-only would be incorrect. You might say its a de-facto irreversible transaction once enough blocks have been added onto the chain, (this is why it often takes several blocks to confirm a single transaction, to ‘bury’ a transaction deep enough into the ledger) but it is by no means absolutely irreversible.

I don’t really have any response for this comment as it is so very difficult to parse. Generally, there seems to be a lot of misunderstanding of what I said, and there are statements that make me scratch my head.

“You are arguing that a product is a fraud because others need to buy the product in order to make money from it.”

Are you trying to say that the greater fool method of selling speculative investments which do not provide utility is valid?

This individual spent a great deal of time writing this, so I think it’s fair to have it posted in case it resonates with another reader.

LoL this entire post is trash. Nobody that understands bitcoin wants to exchange it back for fiat (money by government decree).

However, in this part you actually stumble upon the right answer.

“This absence does not stem from a lack of regulation, it is that Bitcoin does not contain anything that can be regulated. There is nothing here and no room for freedoms, except the right to sell (SPEND) a bitcoin.” (emphasis my own)

But go ahead and keep your hyper inflationary fiat and watch as your TIME is slowly or rapidly (depending on your jurisdictions currency) stolen out from underneath you. Perhaps you are fortunate enough to be a super successful investor and beat inflations hurdle rate. But most people have too much going on in their 9-5 to be the next Nancy Pelosi mega investor. Not being able to save is criminal.

1) The claim that Bitcoin is not used as a speculative investment is dubious. Certainly the people mining Bitcoin are interested in trading it in for fiat.

2) This comment is indicative of common economic delusions that the cryptocurrency industry leverages to exploit people. At this point it should be obvious that Bitcoin is not a hedge against inflation. Moreover, fiat currency should not be used to save, if you are keeping your savings in cash then I would strongly recommend a course on financial literacy. What we want is for agents within the economy to be productive, we want currency to be spent, and we want the velocity of money in the economy to be high. A constant inflationary pressure incests economic agents to put their currency to productive use, as opposed to hoard it.

I agree that the existing financial system has systemic issues and is subject to corruption, however, it does not follow that cryptocurrency is the answer. In fact, cryptocurrencies undermine what little accountability currently exists.

An interesting writeup with many novel and well thought out components.

However, I will quibble with the following – while concurring with the overall drift:

1) The author implicitly assumes Nakamoto is a scammer and that the creation of bitcoin was for retail/personal fraud purposes. This assumption is not the least bit clear since Nakamoto has, to date, never used the enormous initial bitcoin supply under his/her/its control. A curious scammer indeed to not profit from an enormously successful scheme…

Another possibility is that bitcoin was created for illicit, non-fraud purposes such as evading currency controls (its largest original use case) or safely paying off spies/traitors/informants. The CIA, NSA, GCHG or similar Western agencies have a clear and compelling need for such a capability – and there are numerous examples of Western intel agency needs yielding heavily used products such as Tor. Tor is a system for enabling internet anonymity, created at the behest and funding of the US Office of Naval Intelligence; the use of Tor by pro-democracy activists, child porn ecosystem participants, criminals, privacy loving people etc is core to its successful function.

2) The classification writeup has serious weaknesses.

Ransomware is not fraud, it is extortion: pay or don’t get access to your data/IT. Extortion is a threat, fraud is misrepresentation.

Fraud is classified as the act of theft of value plus intent to defraud; it isn’t merely the system itself. Ponzi scheme lower actors are not automatically committing fraud, for example, even though they participate in it.

3) The author neglects that perception of value is value. The entire field of collectibles ranging from Monet to stamps to Franklin Mint is based on perception of value. Is the Franklin Mint pushing collectible porcelain dolls, fraud? Is the art dealer promoting a “hot new artist” promoting fraud? How is promoting bitcoin different?

4) The author also neglects that even a true fraud in both intent to commit fraud and deliberate design to enable fraud, does not mean the outcome is “not real”. Michelangelo committed art forgeries; a least a few of these forgeries were celebrated in and of themselves even when revealed to be so. There are many other examples.

5) While bitcoin is not currency, inflation hedge, digital gold etc – the assertion that bitcoin is not a store of value remains to be seen. Bitcoin is no different than stock from a money-losing company. 41% of S&P1500 plus S&PCompletion companies lost money as of Q3 2021 – i.e. do not have any clear economic value. Are these all frauds too?

The reality is that bitcoin has, at least right now, successfully made the transition from “nerd art” i.e. collectible into “asset” as in BlackRock and many other financial institutions enabling their clients to invest in it. Ethereum is trying to make the same transition, but it is certain that only a handful or less of the cryptocurrencies will ever do so.

From my view, while this article was a tour-de-force technical and criminologic exposition of proof-of-work, it ultimately will do nothing to change the dynamic of bitcoin, much less the “shitcoins”; what will kill bitcoin will be some combination of CBDCs and government regulatory initiated financial system purge – which, if Nakamoto is really a Western intel agency, will never happen. Even if this not so, the penetration which bitcoin has achieved into the existing financial system is such that only highly authoritarian governments have both the will and capability of excising bitcoin; it is completely unclear that Western governments can or will.

1) I partially agree with the criticism about Nakamoto’s fraudulent intent, I will be publishing an article in regards to this shortly. I have seen no evidence to support the assertion that any governmental agency was involved in the creation of Bitcoin, and so have no comment on this claim other than I doubt its veracity.

2) I agree that ransomware is not fraud, though it is a form of criminality, perhaps better categorized as a form of theft, which we could categorize fraud under as well. I used ransomware as an example of when we choose a new name for a type of fraud, so I could have chosen better here, or perhaps been more general in the sense that we choose to group exploitative behaviours and chose names for them. I don’t think this really changes anything about the subject being discussed however.

3) Bitcoin is substantively different in this case. Bitcoin is certainly not being sold as a piece of performance art, nor is it a unique item, there will be 21M identical bitcoins.

That being said, let us consider your example. In the case of art, the buyer can decide on the subjective valuation of the utility provided by the piece. Simply put, they can decide how much they like a painting and determine how much that’s worth to them, alternatively if they view it as an investment, they could decide that the piece will be useful in that way and put a price on it once again. Moreover, the artist must typically create the work in advance, there is some effort that is required and that will translate over to the utility provided and the subjective valuation. So we have objective utility provided by the piece of art, and a subjective valuation based on the buyer.

Again, I am going to have to say please check out my next article, but Bitcoin is fundamentally different in that it’s not a rational economic exchange, it is a network that demands objective value, and provides subjective utility. Bitcoin says, ‘Give me money up front, and take this, it might be useful for something’, where as non-fraudulent economic exchanges say ‘Here is something that I have made that’s useful, it might be worth something’. This inversion of a rational economic exchange is implemented through PoW in Bitcoin. We might say that the Bitcoin network is consumptive as opposed to productive, or that it is an antinetwork.

4) Here I think I disagree, but I would need more clarification on what you are disagreeing with. The fiat dollars which are captured via fiat on ramps certainly are real. The costs demanded by Bitcoin to participate are real. The virtual returns guaranteed by the halving schedule certainly arent real and can’t exist without fiat on ramps and greater fools. Look to my next article for an expansion about value and utility inside Bitcoin.

5) The statement that Bitcoin is the same as a stock that is losing money is entirely incorrect. The legal and regulatory boundaries placed around equities are specifically designed to prevent people from selling smoke and mirrors. It is not a perfect system, but it is one that is supposed to be designed so that companies are forced to provide utility. That utility could be cashflow, or it could be a great product idea, roadmap, prospectus, etc. that is vetted and audited so that potential investors can decide for themselves how much of a risk they want to take. This is fundamentally different than crypto, both in theory and in practice. Because cryptocurrencies exist outside this legal framework, they do not have any incentive to actually produce utility, their incentives exist in the form of creating hype to garner further investment from the public which is then stolen.

6) Thank you for the kind words. I do hope that institutional momentum can be changed to recognize Bitcoin for what it really is.

Well done. I think you have managed quite well to take the subject of Bitcoin as a chess board and play the black/negative figures while completely missing the opposing whites.

So Bitcoin is exploitative behavior by intent of Nakamoto? Well maybe, perhaps it is your opinion, and many who dislike or feel threatened by cryptocurrencies will like to hear that. I do not think so, but our opinions do not matter. Bitcoin has shown that it is possible to have digital tokens like money and transact with them over the Internet without trusting any central authority. That alone has utility (interest by many people) as an idea, similar to how a patent can be recognized as valuable. Further more there is a real operational implementation of the idea, which works for more than a decade and allows people to transact. There is tremendous demand from people all around the world to transact and communicate freely. That means utility to them. If something makes it possible – it has utility for these people.

Not as stable as US Dollar, it may not be strictly speaking a currency, but if the people want to use it like that anyway, what do you have to say? Are they immediately fraudulent? The volatility is an open problem caused by demand and offer. That can be, in some well known scenarios illegal exploitative behavior as in any other market manipulation, which is an old regulated thing not a Bitcoin thing.

Moreover Bitcoin has opened Pandora’s box of permission-less decentralized cryptocurrencies, which are here to stay and to establish itself as a modern form of money. Or should it be rather completely outlawed based on your arguments? That would not have any utility neither and it would just destroy all the utility it has and potentially may have in the future.

Hi Max,

Thanks for your reply. There certainly is room for debate over the intent of Nakamoto. Unfortunately, as I discussed at length in The Trial of Satoshi Nakamoto, Nakamoto’s true intent is unknowable. However, we can infer what is most likely based on what Nakamoto stated and what they built.

I think we should dispense with the attempt to refer to Bitcoin as a currency. It simply cannot function as one, as per its design. Nakamoto perhaps revealed too much when he wrote:

“As the number of users grows, the value per coin increases. It has the potential for a positive feedback loop; as users increase, the value goes up, which could attract more users to take advantage of the increasing value.”

In the same thread, Sepp Hasslberger pointed out that given this design, Bitcoin was useless as a method of payment:

“The reason balance of the system is important: if it’s going to be used for payments, you don’t want to have large changes in the value of the coins. It would lead to distortions, I believe, by continually increasing the “purchasing power” of a single coin.

Stability of the coins’ value is desirable for long term use”

So Nakamoto built something that was useless as a payment method, or as a currency, and this was known from the very beginning. It turns out that Sepp was right, and 14 years later Bitcoin is still used as a speculative digital token, not as a currency.

The claim that Bitcoin, and other cryptocurrencies, are decentralized really depends on what you mean by decentralized. Are you referring to the economic incentives that PoW create? Then yes, there is an argument that the functionality of Bitcoin is decentralized. Of course, to argue this, we need to entirely ignore the centralization of mining conglomerates that control the vast majority of the network hash rate.

However, if what you mean by decentralization, and I think this is what most people mean when they use the word, is that no central entities are in CONTROL of the protocol, then this is an entirely ludicrous claim. The Bitcoin ‘ecosystem’ is controlled by private special interest groups who control the source code, run the centralized exchanges that enable fiat onramps, and the mining conglomerates that control Bitcoin’s functionality. Every entity in this environment has a profit motive, and an incentive to make Bitcoin as expensive as possible. This means that other interests cannot be represented in the system. Users who wish to alter the system so that Bitcoin can be a more effective payment system are unable to do so. If the interests of the entities in control are identical and never deviate from one another, and there is no room for dissenting voices, then how is this any different than centralized rule by a dictator?

Decentralization is an illusion used to recruit new participants and fiat liquidity into crypto, it is a lie which can be used to further extend Nakamoto’s “Positive feedback loop” of value. Further, Bitcoin is not a currency or a payment system and is unable to be one based on how Nakamoto designed PoW.

Finally, if we fully consider the economic effects of PoW, then we see why Bitcoin can never be useful. The same economic incentive created by PoW to defend the network against Sybil attacks, also degrades supply side incentives to provide utility. Bitcoin makes up front demands for money, and instead of exchanging that value for something useful, it instead gives you a token which simulates the amount of money that has been spent on acquiring it. In a regular economic transaction, someone selling something is incentivized to make something useful, or do useful work because they won’t get paid if they don’t. Bitcoin, through PoW, inverts this, and instead demands payment, and claims that the purchaser may be able to use bitcoin for something useful in the future.

Bitcoin doesn’t work for the same reasons that paying people a year in advance with no legal or contractual obligations doesn’t work. There is no incentive to provide utility, to do useful work. This is why in your post you couldn’t point to a specific example of how Bitcoin is useful, instead you have vague claims unsupported by evidence. Existing in market solutions that don’t use blockchain or crypto are far more useful, and the main differentiator that Bitcoin claims, decentralization, is a lie.

Bitcoin is an economic dead end.

Pingback: NFT: Gefahr statt Chance – Marcel Waldvogel